The Ultimate Guide to Candlestick Patterns: Mastering Technical Analysis for Stock and Crypto Trading (2026 Edition)

Introduction: The Art of Reading “Price Action”

In the high-stakes world of financial markets, whether you are trading Tesla stocks on Wall Street or Bitcoin on a decentralized exchange, there is one universal truth: Price is King.

Many beginners clutter their screens with dozens of indicators—RSI, MACD, Bollinger Bands, Moving Averages. They look for a “magic arrow” to tell them when to buy. But pro traders know a secret: Indicators are lagging. They only tell you what happened in the past.

If you want to predict the future, you must look at the raw data. You must look at the Price Action. And the most powerful tool to interpret price action is the Japanese Candlestick.

Developed in the 18th century by Munehisa Homma, a legendary Japanese rice trader, candlesticks are not just drawings. They are a visual representation of mass psychology. Every bar tells a story of fear, greed, panic, and conviction.

This is not a quick blog post. This is a Masterclass. In this comprehensive guide, we will take you from the basic anatomy of a candle to advanced triple-pattern formations and risk management strategies.

Chapter 1: The Anatomy of the Battlefield (OHLC)

To understand the war, you must understand the soldiers. A single candlestick summarizes the trading action for a specific time period (1 minute, 1 hour, 1 day, etc.) using four key data points: Open, High, Low, Close (OHLC).

1. The Body (The Real Estate)

The wide part of the candle is the “Body.” It represents the battleground between the opening price and the closing price.

- Green (or White) Body: The price closed higher than it opened. This is Bullish. The buyers were in control.

- Red (or Black) Body: The price closed lower than it opened. This is Bearish. The sellers were in control.

- The Size Matters: A long body indicates strong momentum and conviction. A short body indicates indecision or a slowdown in momentum.

2. The Wicks (The Shadows of Rejection)

The thin lines extending above and below the body are called Wicks or Shadows.

- Upper Wick: Shows the highest price reached. A long upper wick means buyers tried to push the price up, but sellers slapped them back down. It is a sign of selling pressure.

- Lower Wick: Shows the lowest price reached. A long lower wick means sellers tried to crash the price, but buyers stepped in to buy the dip. It is a sign of buying pressure.

Chapter 2: The “Indecision” Candles (Wait and See)

Before we look for reversals, we must identify when the market is confused.

1. The Doji (The Cross)

A Doji has virtually no body. The Open and Close prices are identical. It looks like a cross.

- Psychology: It represents a perfect stalemate. Neither bulls nor bears won.

- Strategy: A Doji often signals a pending reversal. If you see a Doji at the top of a massive uptrend, be careful—the buyers are running out of steam.

2. The Spinning Top

Similar to a Doji, but with a small body and equal-sized wicks on top and bottom.

- Psychology: The market is “taking a breath.” It indicates consolidation.

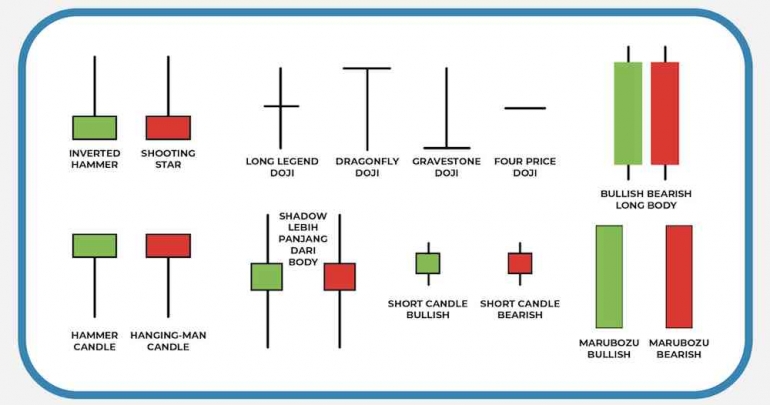

3. The Marubozu (The Dominator)

A candle with a long body and NO Wicks.

- Green Marubozu: Opened at the low, closed at the high. Buyers were in total control from start to finish. (Very Bullish).

- Red Marubozu: Opened at the high, closed at the low. Sellers were in total control. (Very Bearish).

Chapter 3: Single Candle Reversal Patterns (The Snipers)

These patterns consist of just one candle but provide powerful signals when found at key Support or Resistance levels.

1. The Hammer (Bullish)

- Shape: Small body at the top, very long lower wick (2-3x the size of the body), little to no upper wick.

- Location: Must appear at the bottom of a downtrend.

- Meaning: “The sellers tried to push us down to hell, but we survived and pushed back.” It signals the bottom is near.

2. The Shooting Star (Bearish)

- Shape: Inverted Hammer. Small body at the bottom, very long upper wick.

- Location: Must appear at the top of an uptrend.

- Meaning: “The buyers tried to break out, but they failed.” It signals the rally is over.

3. The Hanging Man (Bearish)

- Shape: Looks exactly like a Hammer, but it appears at the top of an uptrend.

- Meaning: Even though buyers managed to close near the top, the long lower wick shows that sellers were able to push the price down significantly during the session. It’s a warning sign of weakness.

Chapter 4: Dual Candle Patterns (The Power Couples)

Two candles provide more context than one.

1. Bullish & Bearish Engulfing (The Tsunami)

This is one of the most reliable patterns in trading.

- Bullish Engulfing: A small red candle is followed by a giant green candle that completely “swallows” the previous red body. It shows a massive shift in sentiment from fear to greed.

- Bearish Engulfing: A small green candle is followed by a giant red candle. It shows the bears have taken over with overwhelming force.

2. The Harami (The Pregnant Woman)

“Harami” means pregnant in Japanese.

- Shape: A large “Mother” candle followed by a tiny “Baby” candle that is completely contained within the body of the mother.

- Meaning: Volatility is contracting. A breakout is imminent.

- Bullish Harami: Big Red Candle + Small Green Candle (inside).

- Bearish Harami: Big Green Candle + Small Red Candle (inside).

3. Tweezer Tops and Bottoms

- Tweezer Bottoms: Two candles with identical lows. It shows a “Double Floor” where price refused to go lower twice. (Bullish).

- Tweezer Tops: Two candles with identical highs. It shows a “Double Ceiling.” (Bearish).

4. Piercing Line & Dark Cloud Cover

- Piercing Line (Bullish): A red candle is followed by a green candle that opens lower (gap down) but closes above the 50% mark of the previous red candle. It shows buyers are aggressively reclaiming territory.

- Dark Cloud Cover (Bearish): A green candle is followed by a red candle that opens higher but closes below the 50% mark of the previous green candle.

Chapter 5: Triple Candle Patterns (The Confirmations)

These rare formations involve three candles and are considered very strong signals.

1. Morning Star (The Sunrise)

A bullish reversal pattern found at the bottom of a downtrend.

- Candle 1: Long Red Candle (Bearish momentum).

- Candle 2: Small body (Star/Doji) indicating indecision.

- Candle 3: Long Green Candle that closes well into the body of the first candle.

- Story: The darkness (red) was stopped by indecision (star), and the sun rose (green).

2. Evening Star (The Sunset)

A bearish reversal pattern found at the top of an uptrend.

- Candle 1: Long Green Candle.

- Candle 2: Small body (Star) at the top.

- Candle 3: Long Red Candle crashing down.

- Story: The party is over. The sun has set.

3. Three White Soldiers (The Army)

- Pattern: Three consecutive long green candles with short wicks, each closing higher than the last.

- Meaning: Extremely bullish. It indicates a steady, powerful march upward.

4. Three Black Crows (The Doom)

- Pattern: Three consecutive long red candles, each closing lower than the last.

- Meaning: Extremely bearish. The market is collapsing.

Chapter 6: The Secret Sauce – Context & Confluence

Warning: This is the most important part of the guide. If you trade every Hammer you see, you will go bankrupt. You must trade patterns in Context.

1. Support and Resistance

A Hammer pattern in the middle of a chart means nothing. But a Hammer pattern that touches a key Support Line (a price floor) is gold.

- Rule: Only look for Bullish patterns at Support.

- Rule: Only look for Bearish patterns at Resistance.

2. Volume Confirmation

Volume is the fuel of the market.

- If you see a “Bullish Engulfing” candle, check the volume bars below. Is the volume high?

- High Volume = Smart Money (Institutions) are buying. Real move.

- Low Volume = Retail traders are buying. Fake move.

3. Timeframe “Matryoshka” Dolls

Don’t get stuck on one timeframe.

- A “Shooting Star” on the 15-minute chart might look scary, but if the 4-Hour chart shows a massive “Green Marubozu,” the trend is still up.

- Pro Tip: Always check the Higher Timeframe (HTF) to see the bigger picture, then use the Lower Timeframe (LTF) to find your entry entry.

Chapter 7: Risk Management (Where to Put the Stop Loss)

The best traders are not the ones who predict correctly; they are the ones who lose the least when they are wrong. Candlesticks tell you exactly where to put your safety net (Stop Loss).

The Rule of the Wick:

- For Long (Buy) Trades: Place your Stop Loss slightly BELOW the lowest wick of your setup candle (e.g., below the Hammer’s tail).

- Why? If the price goes below the tail, the Hammer pattern has “failed” and the thesis is invalid. Get out immediately.

- For Short (Sell) Trades: Place your Stop Loss slightly ABOVE the highest wick of the setup candle (e.g., above the Shooting Star).

Risk-to-Reward Ratio (RR): Never enter a trade unless the potential profit is at least 2x the potential loss.

- If your Stop Loss is -2%, your target profit should be +4% or more.

Conclusion: Patience is the Ultimate Skill

Mastering candlestick patterns is like learning a new language. At first, you will translate slowly. But with practice, you will be able to glance at a chart and instantly understand the story.

Do not rush. Do not “revenge trade.” Wait for the perfect setup. Wait for the Hammer at Support. Wait for the Morning Star at the bottom. As the legendary trader Jesse Livermore said: “It was never my thinking that made the big money for me. It was always my sitting.”

Start practicing today on a Demo Account. Look for these patterns. Verify them. And soon, you will see the market not as chaos, but as a structured dance of psychology and math.

🧱 Glossary of Terms

- Bull/Bullish: Buyers are in control; price goes up.

- Bear/Bearish: Sellers are in control; price goes down.

- Trend: The general direction of the market (Up, Down, or Sideways).

- Reversal: A change in the direction of the trend.

- Consolidation: The price is moving sideways; indecision.

🛡️ DISCLAIMER

This comprehensive guide is for educational purposes only. Daily Dejavu is not a licensed financial advisor. Trading involves substantial risk of loss and is not suitable for every investor. Past performance is not indicative of future results.