Why Getting Richer Makes You Poorer: The Diderot Effect (2026 Guide)

Let’s be real for a second. We’ve all played out this scenario in our heads: “If I just earn an extra $1,000 a month, all my problems will vanish. I’ll save more, I’ll invest, and I’ll finally be at peace.”. Understanding the Diderot Effect is crucial if you want to stop living paycheck to paycheck, no matter how much you earn.

Then, the miracle happens. You get that promotion. Your side hustle takes off. The numbers in your bank account actually go up. But three months later? You are exactly where you started.

You aren’t saving more. You’re just wearing better shoes while stressing about the same empty savings account.

What happened? Did the universe conspire against you? No. You just fell into a psychological trap that has been bankrupting smart people since the 18th century. It’s called The Diderot Effect.

It’s the reason why buying a new iPhone feels like a necessity, not a luxury. It’s the reason why “Lifestyle Creep” is the silent killer of wealth. And understanding it is the only way to stop your money from burning a hole in your pocket.

The Story of the Scarlet Robe (Or: How a French Philosopher Went Broke)

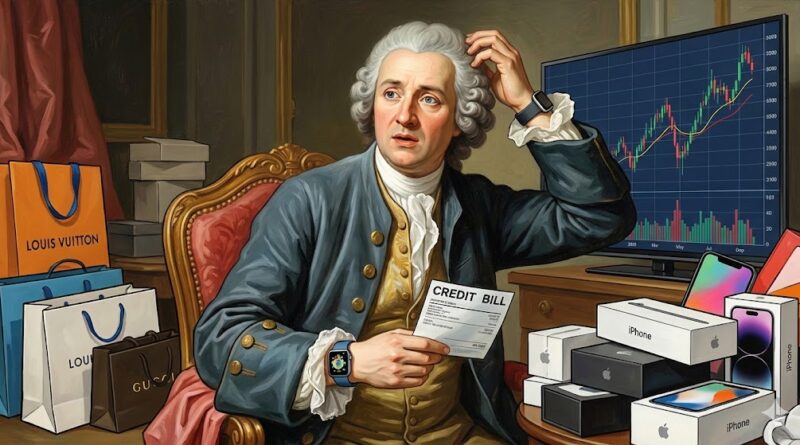

To understand why you can’t save money in 2026, we have to travel back to France in 1765.

Meet Denis Diderot. He wasn’t some random guy; he was a famous philosopher and the co-founder of the Encyclopédie. Despite his fame, Diderot was broke. Like, “can’t pay for his daughter’s wedding” broke.

Hearing of his financial struggles, Catherine the Great, the Empress of Russia, decided to help. She bought Diderot’s library for a massive sum of money. Suddenly, Diderot was rich. He had cash to burn.

So, he did what any of us would do: He bought something nice. Specifically, he bought a beautiful, expensive Scarlet Robe (a fancy dressing gown).

It was elegant. It was luxurious. It was perfect. But there was a problem. When Diderot wore his new robe and sat in his study, he noticed something annoying. His desk looked trashy compared to the robe. His chair was old and rugged. The rug was faded.

The robe was too nice. It made everything else look like garbage.

So, Diderot started upgrading.

- He replaced his old rug with a rug from Damascus.

- He swapped his wooden chair for a leather one.

- He bought expensive prints to hang on the wall.

- He replaced his straw desk with a fancy writing table.

Before he knew it, he had spent all his money. He was now the owner of a luxurious study, but he was broke again.

Diderot later wrote an essay titled “Regrets on Parting with My Old Dressing Gown.” In it, he wrote a sentence that perfectly captures modern consumerism:

“I was absolute master of my old dressing gown, but I have become a slave to my new one.”

The Psychology Behind The Diderot Effect: Why One Purchase Triggers a Chain Reaction

This isn’t just a story about a guy with poor impulse control. It is a fundamental truth about human psychology.

The Diderot Effect states that obtaining a new possession often creates a spiral of consumption which leads you to acquire more new things. In simpler terms: New things make old things look bad.

We rarely buy things in isolation. We buy things to create a “Set” or an “Identity.” Your possessions are a reflection of who you think you are.

- The “Runner” Identity: You decide to start jogging. You buy $150 running shoes. Suddenly, your old cotton t-shirt looks unprofessional. You need moisture-wicking shirts. Then you need a Garmin watch. Then you need specialized socks. You haven’t run a mile yet, but you’ve spent $500.

- The “Gamer” Identity: You buy a PS5. Now your old 1080p TV looks blurry. You need a 4K OLED. Now the sound is flat, so you need a soundbar. Now your couch is uncomfortable for long sessions.

You are not buying utility. You are buying a cohesive narrative. You are trying to make your outside world match the “New You” that the first purchase created.

Lifestyle Creep: The Silent Wealth Killer

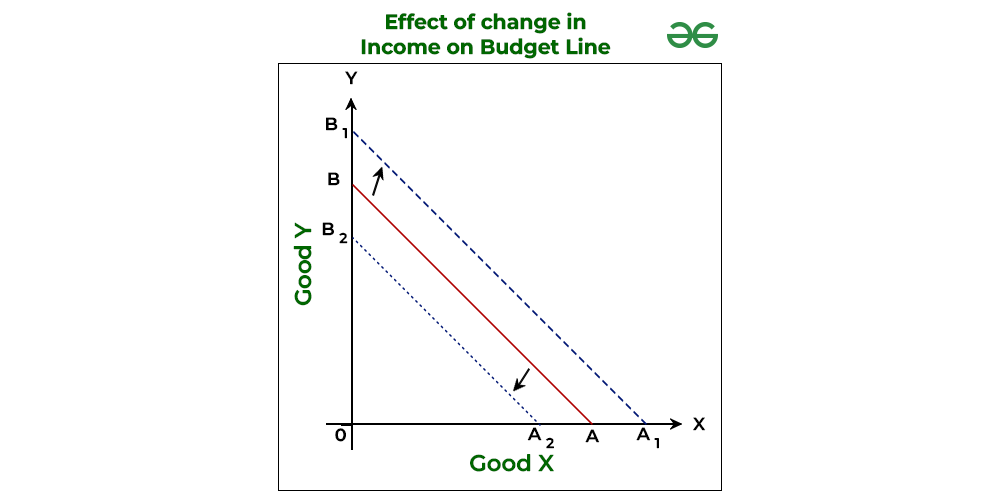

This brings us to Lifestyle Creep. Lifestyle Creep is the Diderot Effect applied to your salary.

When you were a fresh graduate earning minimum wage, you survived. You ate instant noodles, drank instant coffee, and shared a flat. You were happy enough. Now, you earn 5x that amount. But are you 5x happier? Probably not.

Why? Because your “baseline” for happiness has shifted.

- Old You: Happy with a $2 coffee.

- New You: Needs a $6 Starbucks latte because “I work hard, I deserve it.”

- Old You: Happy with a reliable used Toyota.

- New You: Needs a new SUV because “It’s safer and fits my image.”

The problem with Lifestyle Creep isn’t that you’re spending money. It’s that you are raising the floor of your existence. Once you get used to business class, economy feels like torture. Once you get used to fine dining, warung food feels risky.

You are running on a hedonic treadmill. You have to run faster (earn more) just to stay in the same place (feel the same level of satisfaction).

How to Escape the Trap (Without Living Like a Monk)

Look, nobody is saying you have to live in a cave and wear potato sacks. We like nice things. Nice things are cool. But you need to be the Master of your things, not the Slave (like Diderot).

Here is how you hack the system:

1. The “One In, One Out” Rule

This is the ultimate defense against clutter and the Diderot Effect. If you buy a new pair of sneakers, you must throw away or donate an old pair. This forces you to ask: “Is this new item really better than what I have? Or is it just… new?”

2. Beware of the “Upgrade Chains”

Before you buy something big, pause and look at the invisible chain attached to it.

- Buying a new dress? Ask: “Do I have shoes that match this? Do I have a bag for this?”

- Buying a new iPad? Ask: “Am I going to want the Pencil and the Magic Keyboard too?” If the answer is “No, I need to buy those too,” you aren’t spending $500. You are committing to spending $1,000. Calculate the Total System Cost, not just the item cost.

3. Buy for Utility, Not Identity

Stop buying things to prove you are a certain type of person.

- Don’t buy a $3,000 camera to become a photographer.

- Buy a $3,000 camera because you already are a photographer and you’ve outgrown your current gear. Let your skills demand the upgrade, not your ego.

4. The 30-Day Waitlist

If you see something you desperately want (that isn’t food or medicine), put it on a list on your phone. Wait 30 days. 90% of the time, the emotional “itch” to buy it will disappear after a week. The Diderot Effect thrives on impulse. Time is its kryptonite.

Conclusion: Enough is a Decision, Not an Amount

Denis Diderot died in 1784. His philosophy books are great, but his accidental lesson on finance is legendary.

Getting rich doesn’t make you broke. Thinking that “More Stuff = Better Life” makes you broke. There will always be a better phone, a faster car, and a bigger house. The upgrade cycle never ends unless you choose to end it.

The next time you get a raise, or a bonus, or a sudden windfall—remember the man in the Scarlet Robe. Go ahead, treat yourself. But maybe, just maybe, keep your old comfortable chair. It fits you better than you think.Diderot Effect