The Art of the Chip Deal: Why Trump Just Sold AI Power to China for a 25% Cut

WASHINGTON D.C. — For years, the narrative coming out of Washington was clear, rigid, and uncompromising: China must be starved of advanced Artificial Intelligence chips at all costs. The fear was that giving Beijing access to high-end silicon would accelerate their military modernization and cyber capabilities.

But in the world of Donald Trump, ideology often takes a backseat to the bottom line.

In a stunning reversal of the “total blockade” strategy that defined the Biden years, President Trump has announced that the gates are opening—slightly. The United States will now allow Nvidia to export its powerful H200 chips to China.

But, as with any deal struck by the author of The Art of the Deal, there is a catch. A massive, unprecedented catch. The chip shipments come with a 25% “Patriot Tax”—a cut of the revenue that goes directly into the coffers of the United States Treasury.

This move effectively transforms the US government from a regulator into a shareholder in the global semiconductor trade. It is a pivot from “Strategic Denial” to “Strategic Profiteering.”

At Daily Dejavu, we are dissecting this controversial move. Is this a brilliant economic play to fund American re-industrialization, or is it a dangerous gamble that hands China the very weapon it needs to win the AI arms race?

Part I: The H200 – The “Golden Handcuff”

To understand the deal, we must first look at the merchandise. The Nvidia H200 is a monster of a chip. When it launched, it was the fastest AI accelerator on the planet, boasting 141GB of HBM3e memory. It is the engine that trains Large Language Models (LLMs) like GPT-4 and China’s Ernie Bot.

Why allow it now? Critics might argue that selling H200s to China is suicide. However, the tech landscape moves fast. While the H200 is powerful, it is no longer the apex predator. That title now belongs to Nvidia’s newer architectures: Blackwell and Rubin.

Trump’s strategy is nuanced:

- The Ban Remains: The cutting-edge Blackwell and Rubin chips remain strictly BANNED for export to China.

- The Allowance: The H200 (now considered “Tier 2” tech) is allowed.

The Logic: The US is essentially saying: “You can buy our second-best technology to keep your economy running, but you cannot have the tools to beat us.” It is a strategy of “Calculated Lag.” By flooding China with H200s, the US keeps Chinese tech companies dependent on American silicon, rather than forcing them to desperately develop their own alternatives (like the Huawei Ascend series). It keeps China hooked on the Nvidia ecosystem, but always one step behind.

Part II: The 25% “Vig” – State Capitalism, American Style

The most shocking part of this announcement isn’t the chips; it’s the money.

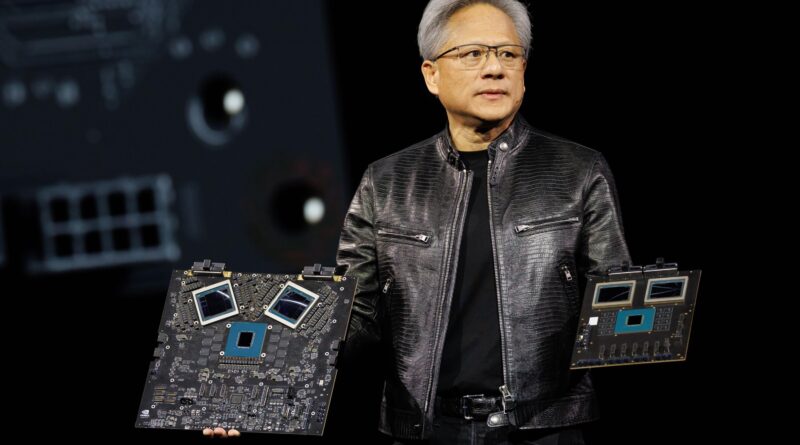

“25 percent will be paid to the United States,” Trump posted on Truth Social, following his meeting with Nvidia CEO Jensen Huang.

In the world of organized crime, this is called a “vig.” In the world of sovereign states, it is usually called a tariff. But this is something new. It appears to be a direct revenue-sharing model where the US government acts as a broker.

The Math:

- An Nvidia H200 chip costs roughly $40,000.

- If Nvidia sells 100,000 units to China (a conservative estimate), that is $4 billion in revenue.

- Under this deal, $1 billion goes straight to the US government.

This funds “high-paying jobs and manufacturing in America,” according to Nvidia’s spokesperson. Essentially, Trump is using Chinese demand for AI to subsidize the American budget. It is a move that borrows heavily from the playbooks of “State Capitalist” nations like Singapore or China itself.

Part III: The “Xi” Factor – Why Did China Agree?

Trump claimed that President Xi Jinping “responded positively” to the arrangement. On the surface, this seems humiliating for Beijing. Why would China agree to pay a premium that funds its rival?

1. The Domestic Reality Check As we reported earlier this week, China has built a prototype EUV machine in Shenzhen. That is a massive achievement. However, a prototype is not a factory. Mass production of domestic Chinese chips is likely still 2-4 years away. In the fast-moving world of AI, 4 years is an eternity. If Baidu, Tencent, and Alibaba have to wait 4 years for chips, they will be obsolete.

2. The Stopgap Solution China needs computing power today. Buying the H200—even with the 25% markup—is a necessary evil. It buys time for Huawei and SMIC to perfect their own manufacturing processes without crashing the Chinese AI economy in the meantime. Xi is playing the long game: tolerate the tax now, aim for independence later.

Part IV: The Corporate Sigh of Relief

For Jensen Huang (CEO of Nvidia) and Lisa Su (CEO of AMD), this news is better than Christmas.

For the past two years, Nvidia has been in a painful position. They designed the world’s best chips, but the US government forbade them from selling to their biggest market (China).

- They tried to make “watered-down” versions (like the H20), but Chinese clients weren’t interested.

- They watched helplessly as Huawei started eating their market share in China.

The Floodgates Open: With this executive order, Nvidia can once again access the billions of dollars flowing from Shenzhen and Beijing. “We appreciate President Trump’s decision,” an Nvidia spokesperson said. The phrasing is careful. They frame it as supporting “American competitiveness,” but in reality, it is about shareholder value. Nvidia stock surged 8% immediately following the announcement.

AMD joins the party: The Trump administration noted that a similar approach is being refined for AMD and Intel. This creates a unified front of American chipmakers flooding the Chinese market, effectively stifling the growth of nascent Chinese competitors who suddenly have to compete with the (superior) Nvidia H200.

Part V: The Intel Stake – The Government as Owner

Buried in the coverage of the Nvidia deal is another piece of the puzzle that signals a radical shift in American economic policy. Back in August, Trump announced the government would take a 10% stake in Intel.

Combine this with the 25% cut from Nvidia sales. The line between the “Private Sector” and the “State” in America is blurring.

- The US government is now an investor in Intel.

- The US government is now a revenue-partner with Nvidia.

This is no longer free-market capitalism. This is Mercantilism. The US government is actively managing its national champions to extract wealth from foreign rivals. It is a strategy designed to counter China’s state-owned enterprise model by adopting similar tactics.

Part VI: The Risks – Is Trump Feeding the Dragon?

Not everyone in Washington is celebrating. National security hawks in the Pentagon are reportedly nervous.

The Argument Against:

- “AI is AI”: You don’t need the absolute newest chip to build a dangerous weapon. The H200 is still incredibly powerful. A cluster of 10,000 H200s can train an AI model capable of cyber-warfare, drone swarming, or designing biological weapons.

- The “Smuggling” Loophole: Once these chips enter China for “approved commercial customers,” it is notoriously difficult to track them. Who guarantees that a chip sold to a video game company in Shanghai doesn’t end up in a PLA missile lab in Chengdu?

The “Approved List” Defense: The administration argues that the Department of Commerce has a rigorous vetting process. Only “verified” commercial entities can buy the chips. But as history shows, where there is a will (and billions of dollars), there is a way. Shell companies and middlemen thrive in this environment.

Part VII: The Global Reaction

Europe: European leaders are watching with jealousy. ASML (the Dutch company) is still heavily restricted from selling its machines to China. They see the US allowing its own companies (Nvidia) to profit while forcing European companies to maintain a blockade. Expect diplomatic friction in Brussels.

Taiwan: For TSMC (which manufactures the H200), this is good business volume, but it adds to the geopolitical anxiety. If China becomes dependent on chips made in Taiwan, does that make Taiwan safer (too valuable to bomb) or more at risk (a strategic asset to seize)?

Conclusion: The New World Order is Transactional

We are entering 2026 with a new set of rules. The “Cold War” metaphor is dead. In the Cold War, the US and USSR did not trade. In this new “Chip War,” the enemies trade, but they tax each other into oblivion.

President Trump has bet that the economic benefit of draining billions from China via the “25% Rule” outweighs the military risk of giving them H200 chips. He is betting that American innovation (Blackwell/Rubin) will always stay one step ahead of whatever China can build with the H200s.

It is a high-stakes gamble. If he is right, the US funds its future with Chinese money. If he is wrong, the US just sold the rope that China will use to pull itself ahead.

As the first shipments of H200s prepare to leave ports in California bound for Shanghai, the world watches. The embargo is over. The era of the “Mercenary Chip” has begun.